Stablecoins: Can't Touch This!

With the new BIS proposal, banks are unlikely to add stablecoins to their balance sheet. Fortunately, there is something better available.

Most crypto news media interpreted BIS’ second consultation on the prudential treatment of cryptoasset exposures from June 30, 2022, wrong when stating that the BIS recommend that banks can hold 1% of their reserves in crypto. As Frances Coppola points out in her opinion piece on Coindesk, Banks Aren’t Going to 'HODL' Bitcoin, BIS’ recommendation is quite the opposite of an endorsement for crypto. The introduction of the consultation states

The Committee believes that the growth of cryptoassets and related services has the potential to raise financial stability concerns and increase risks faced by banks. Certain cryptoassets have exhibited a high degree of volatility, and could present risks for banks as exposures increase, including liquidity risk; credit risk; market risk; operational risk (including fraud and cyber risks); money laundering / terrorist financing risk; and legal and reputation risks.

France’s excellent article explains why banks won't add crypto to their balance sheets.

BIS proposes a structure for classifying cryptoassets.

Group 1 cryptoassets are those that meet in full a set of classification conditions. These are tokenized traditional assets (Group 1a) and stablecoins that meet narrow criteria for stability and redeemability (Group 1b).

Group 2 cryptoassets are those that fail to meet any of the classification conditions. Group 2 is deemed to be riskier than Group 1 and is therefore subject to more stringent regulations.

For a stablecoin to join Group 1b, it would need to meet the following two tests:

Redemption risk test: Ensure that the reserve assets are sufficient to enable the cryptoassets to be redeemable at all times, including during periods of extreme stress.

Basis risk test: Ensure that the holder of a cryptoasset can sell it in the market for an amount that closely tracks the peg value. The test includes thresholds. Specifically:

If the peg-to-market value difference does not exceed 10bp more than 3 times over the prior 12 months, the cryptoasset has “fully passed” the basis risk test.

If the peg-to-market value difference exceeds 20bp more than 10 times over the prior 12 months, the cryptoasset has “failed” the basis risk test.

If the cryptoasset has neither “fully passed” nor “failed” the basis risk test, it is considered to have “narrowly passed” the basis risk test. Cryptoassets that meet all the classification conditions for inclusion in Group 1b, but only narrowly pass the basis risk test, will be subject to an add-on to risk-weighted assets.

There are minimum capital requirements for banks to hold Group1 cryptoassets. Group 1a cryptoassets are generally subject to the same rules as non-tokenised traditional assets. For Group 1b cryptoassets on the other hand, the total credit risk-weighted assets must be increased by an amount equal to 100% of the exposure value. That would get expensive for banks.

How Would Current Stablecoins Fair Against BIS’ Proposal?

Let’s look at the most common stablecoins in use today and see how they would perform against BIS’ proposal of the ‘basis risk test’ and whether banks could add stablecoins to their balance sheet as Group 1b assets.

A $1.00 stablecoin is supposed to be redeemable for $1.00 in bank deposits. (In this analysis, I will ignore the ‘redemption risk test’) However, that is not always the case. A $1.00 stablecoin that loses its peg by 10 basis points is traded for $0.999. A 20 basis point drop in value would trade the stablecoin at $0.998.

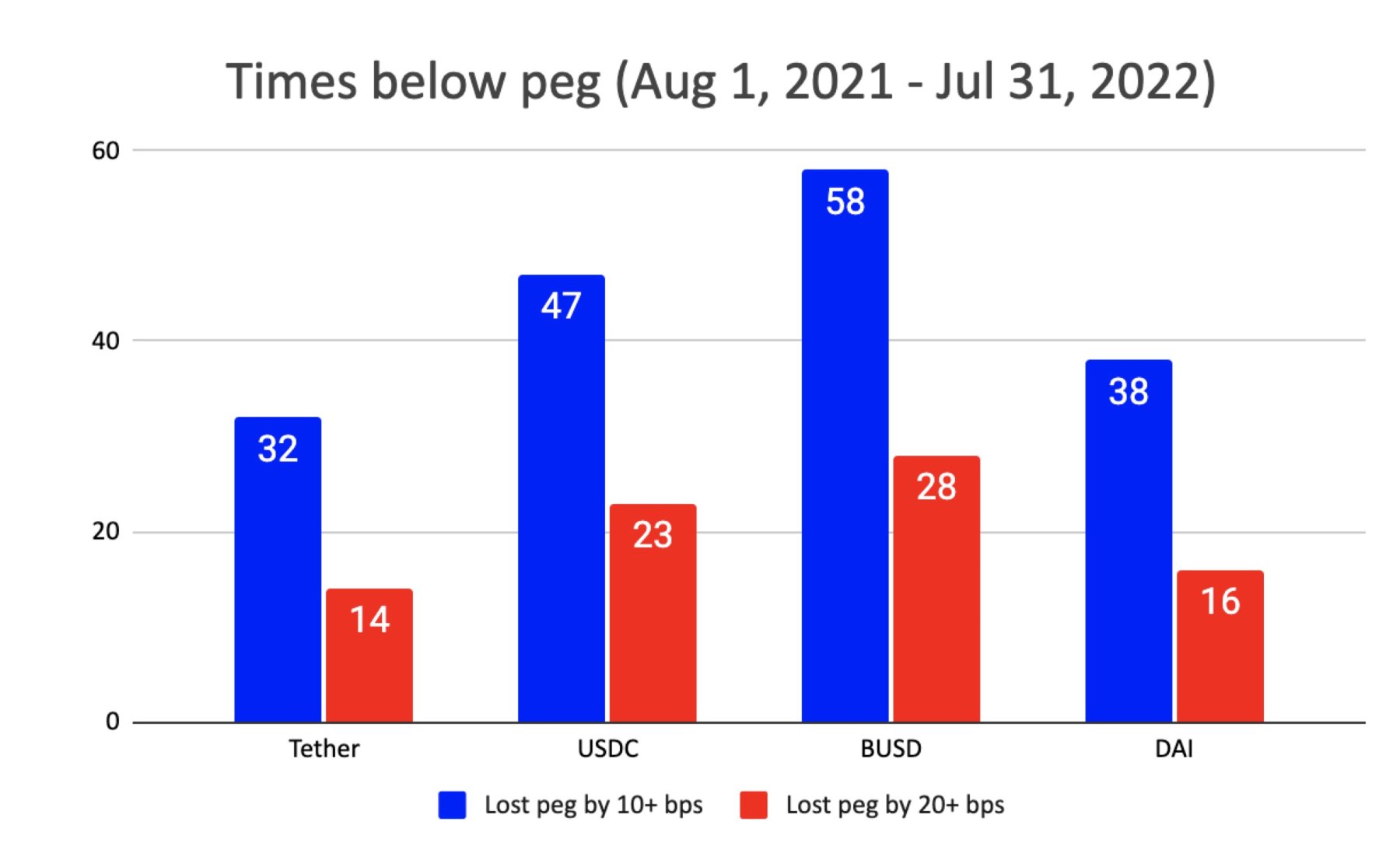

The chart below shows the number of times the four most popular stablecoins (by market cap) have lost their peg by 10, 20, or more basis points between August 1, 2021, and July 31, 2022.

As can be seen, none of the popular stablecoins came close to avoiding the “fail” status. Even if these stablecoins would have gotten below the 20bps threshold, they would still have a long way to go to reach the “fully passed” status. In that case, they would fall into the “narrowly passed” category and be subjected to an add-on to risk-weighted assets.

Conclusion

If the current proposal from BIS becomes the standard, banks that want to hold Group 1b stablecoins as assets would be subject to additional reserve requirements. As a result, banks would be unlikely to add stablecoins to their balance sheets, which ultimately means that banks wouldn’t use stablecoins as payment instruments. Fortunately, there is a solution for banks - tokenized deposits. BIS points out that tokenized traditional assets would fall into Group 1a, which wouldn’t be subject to the same capital requirements rules as Group 1b, thus, less costly.

Tokenized deposits have similar characteristics as cryptocurrencies: instant settlement, low cost and programmability to enable advanced conditional payments. They also have the added benefit of being as stable as bank deposits and typically come with some level of insurance by the government.