CBDC: Stay clear of two-tier confusion

In discussions about central bank digital currencies (CBDCs), the term “two-tier model”, or some variant of it is frequently used. Unfortunately, the two-tier term is confusing as it can have very different meanings. Here’s an attempt to clear it up.

Tiered distribution

Distribution of consumer goods often follow a tiered model. For example, a wine producer sells their wine to a wholesale distributor, who resells the wine to a retailer, who sells the wine to the general public. In this case it’s a three-tier distribution model: producer > wholesale distributor > retailer > consumer.

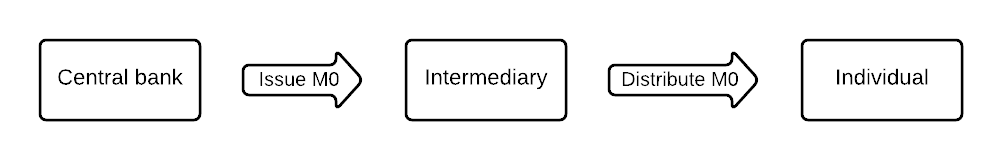

In the context of CBDC, a “two-tier model” is often discussed, but more specifically, it refers to a two-tier distribution model. This means that the central bank issues digital currency (M0 money) to intermediaries such as commercial banks, or other authorized parties. Those intermediaries then distribute the digital currency to consumers (and businesses) for use:

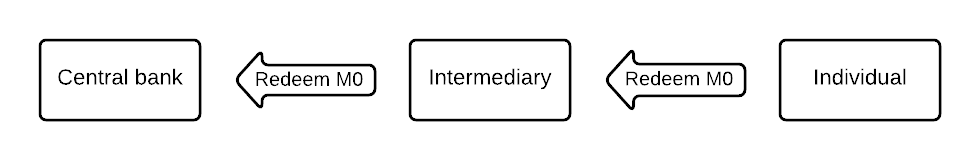

Redemption of the digital currency to bank money then takes the reverse route:

The CBDC is a claim on the central bank. This is how both the e-krona project in Sweden and DCEP in China were designed to work. The Banks for International Settlements (BIS) calls this model hybrid CBDC.

Tiered monetary system

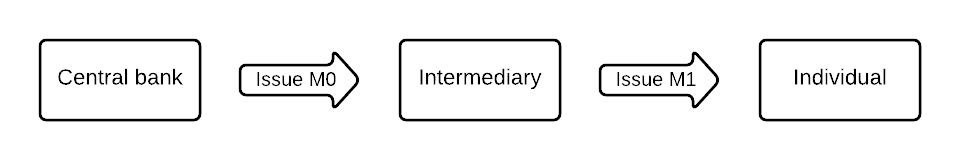

The two-tiered monetary system is a system where central banks supply cash and deposits (M0 money) to commercial banks; and commercial banks provide deposits (M1 money) through credit creation based on the central bank money they hold. The two-tiered monetary system utilizes private innovation in payment services and financial services in general. There is a corresponding CBDC model - Indirect CBDC (BIS terminology), or synthetic CBDC (IMF terminology). Here the central bank issues CBDC (or other form of central bank money) to intermediaries but rather than distributing the CBDC, the intermediary creates its own liability for the end customer.

This means that the digital currency held by consumers is a claim on the intermediary.

For all intents and purposes, the commercial bank liability can be as safe as the CBDC with direct claim on the central bank. Multiple techniques can be used to accomplish this such as backing the commercial bank liability 1:1 by central bank reserves, segregating the deposits from other liabilities, regulation, etc.

Conclusion

When referring to a “two-tier CBDC model”, be specific. Use the terms tiered distribution and tiered monetary system to avoid any confusion.